Invoice processing has been a common task for business owners and accountants. However, despite automation being all around, still over 49% of businesses process invoices manually. In this article, we’ll talk about how to automate your invoice process and the benefits of implementing it.

Automated invoice processing is a system that processes invoices with minimal or no human intervention. It utilizes a series of software, such as OCR, ERP, and accounting software, overseen by people and can be customized throughout the invoice process. By implementing this system, you can streamline your invoice management, reduce errors, and save time. The software automates tasks such as data extraction, validation, and approval, ensuring a smooth and efficient workflow. This not only enhances accuracy but also allows your team to focus on more strategic activities, ultimately improving your business’s overall efficiency and productivity.

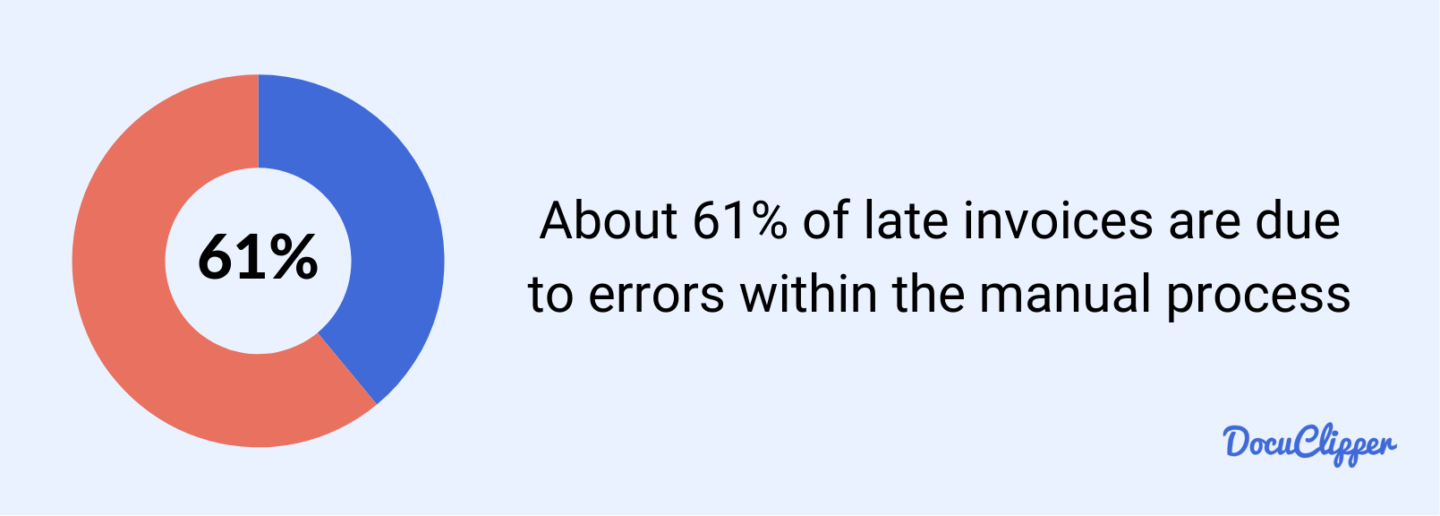

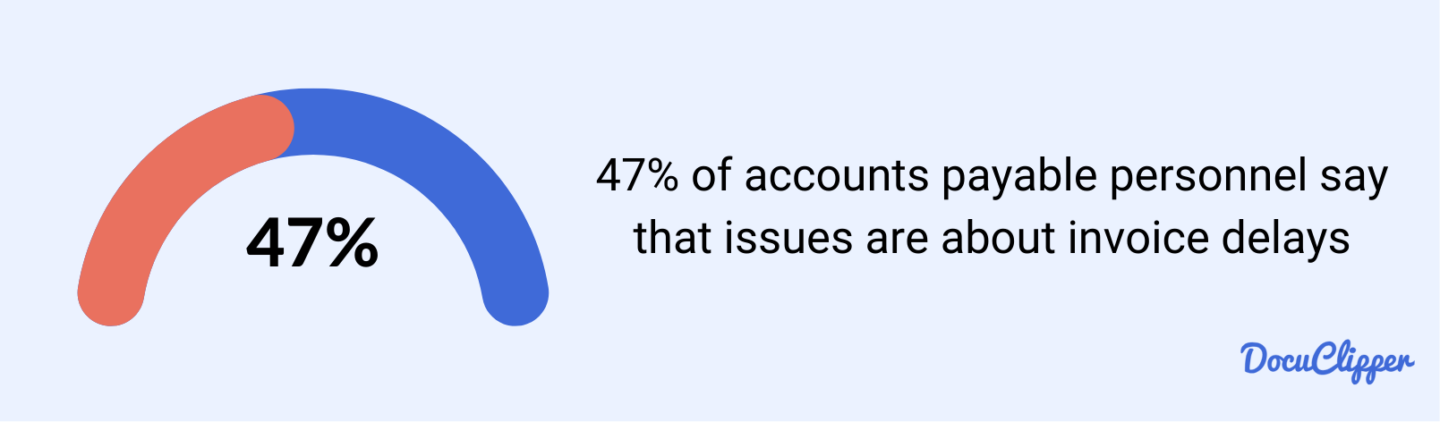

Invoice processing is a foundational function of any business, and automating it can resolve numerous issues. Firstly, manual invoice processing is prone to errors. About 61% of late invoices are due to errors within the manual process.  These late invoices can lead to penalties, additional costs, and strained client-supplier relationships. Moreover, manual invoice processing is traditionally slow. The process involves manual typing, verification, and circulation among multiple people, consuming a lot of time. One of the biggest issues accounts payable personnel face is slow invoice approval, with 47% complaining about its delay. A slow approval process can lead to more late invoices, further complicating matters.

These late invoices can lead to penalties, additional costs, and strained client-supplier relationships. Moreover, manual invoice processing is traditionally slow. The process involves manual typing, verification, and circulation among multiple people, consuming a lot of time. One of the biggest issues accounts payable personnel face is slow invoice approval, with 47% complaining about its delay. A slow approval process can lead to more late invoices, further complicating matters.  Additionally, employing people to manually process invoices is costly. Salaries vary based on the skill levels required, but automating the process can significantly reduce these costs by up to 90%.

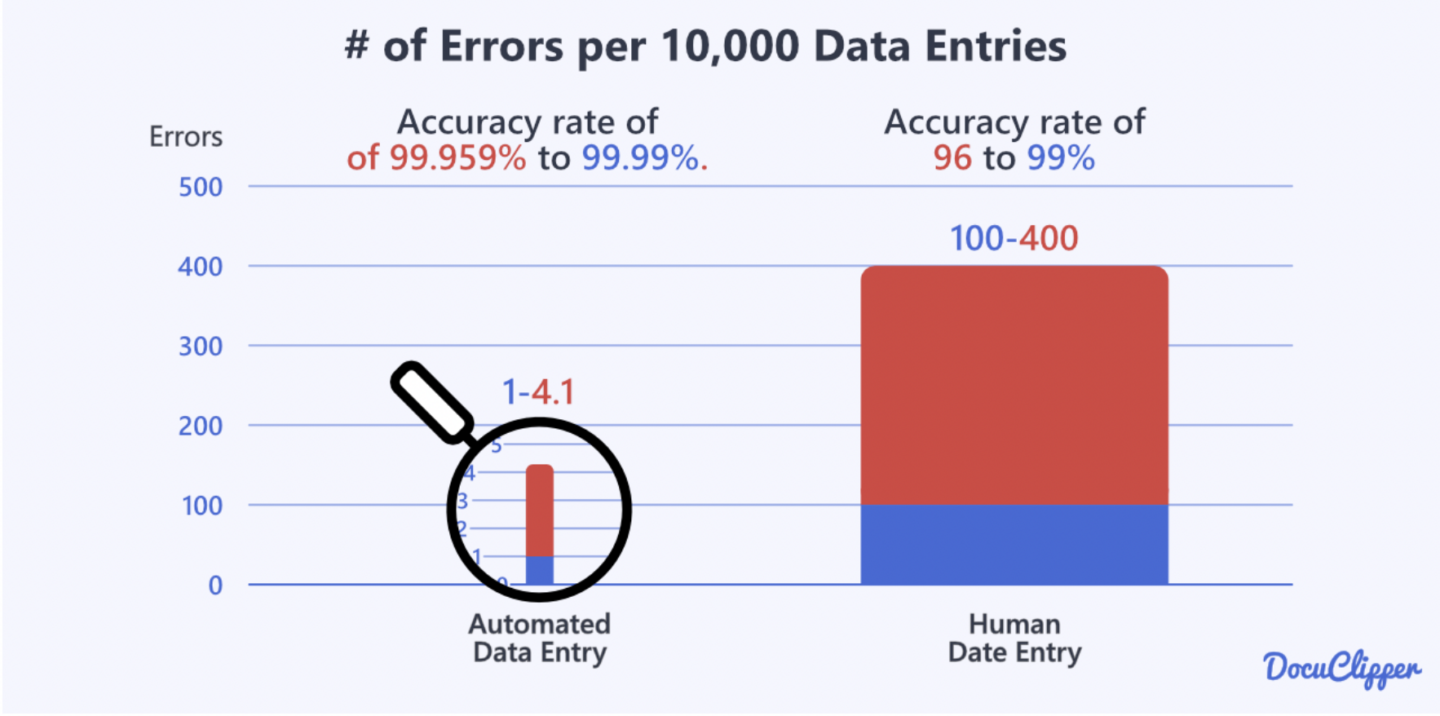

Additionally, employing people to manually process invoices is costly. Salaries vary based on the skill levels required, but automating the process can significantly reduce these costs by up to 90%.  Automation eliminates the need for extensive manual intervention, allowing you to allocate your resources more efficiently. One of the major advantages of automated invoice processing is the seamless integration with accounting systems. These automated systems can easily integrate all your invoice data into ERP systems or accounting software. This integration ensures that your financial data is always up-to-date and accurate, resulting in better financial management and reporting. Automating invoice processing also enhances overall efficiency. The time and effort required to process invoices manually are substantially reduced, allowing your team to focus on more strategic tasks. In fact, The average time to process an invoice manually is 14.6 days. It also minimizes errors associated with manual invoice data entry and processing, ensuring greater accuracy.

Automation eliminates the need for extensive manual intervention, allowing you to allocate your resources more efficiently. One of the major advantages of automated invoice processing is the seamless integration with accounting systems. These automated systems can easily integrate all your invoice data into ERP systems or accounting software. This integration ensures that your financial data is always up-to-date and accurate, resulting in better financial management and reporting. Automating invoice processing also enhances overall efficiency. The time and effort required to process invoices manually are substantially reduced, allowing your team to focus on more strategic tasks. In fact, The average time to process an invoice manually is 14.6 days. It also minimizes errors associated with manual invoice data entry and processing, ensuring greater accuracy.

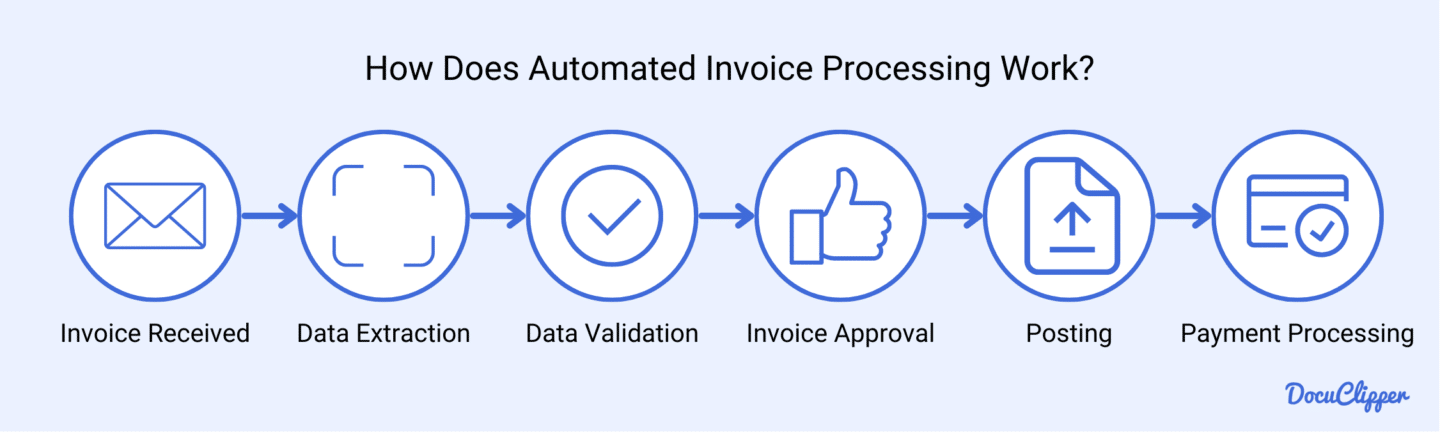

Automated invoice processing follows a systematic workflow to ensure efficiency and accuracy. Here’s a step-by-step breakdown:

Now, this does not mean you need to automated the entire process at once. Usually, companies start with the last 4 steps as common accounting software such as QuickBooks, Xero, or Sage allows you to set these rules.

While if your company only processes a few invoices a month, then you might not need OCR solution.

But once you start to process more and more invoices, then having also invoice OCR software becomes crucial for the reasons mentioned above.

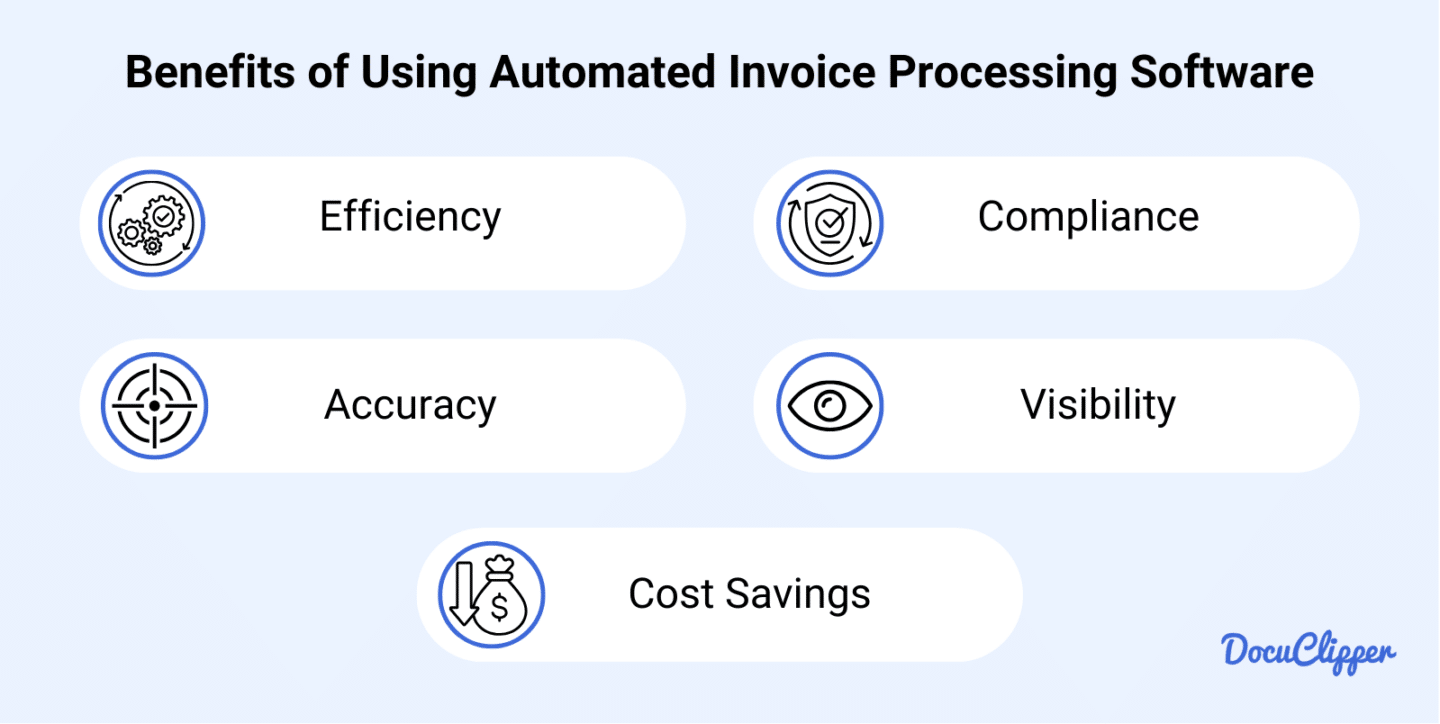

There are many benefits of using an automated process for your invoice processing workflow, here are its notable ones:

Overall, automated invoice processing will become increasingly important as your business grows and the amount of invoices needed to be processed grows.

It will hugely simplify and standardize your operational procedures ultimately resulting in better financial outcomes for your business.

Applying automation in business processes like accounts payable, accounting, and marketing offers numerous benefits. By implementing automated invoice processing, you significantly enhance efficiency, accuracy, and cost savings.

This modern approach smoothens operations, reduces errors, and achieves compliance, ultimately improving your business’s overall productivity and financial health. Transitioning to automation is not just a trend but a strategic move to stay competitive and efficient in today’s fast-paced business environment.

DocuClipper is an excellent choice for invoice data extraction as it eliminates much of the manual intervention needed for capturing data from invoices.

As a cloud-based OCR software, DocuClipper extracts data from invoices, receipts, and financial statements from PDF forms into formats like XLS, CSV, and QBO with high accuracy. These formats can be easily analyzed and integrated into accounting and ERP software, providing enhanced visibility and simplifying invoice approval and verification processes. It can also automatically import invoices into Quickbooks, skipping the exporting and importing process.

DocuClipper’s efficiency and precision make it an indispensable tool for modern businesses looking to streamline their invoice processing.

Here are some frequently asked questions about automated invoice processing:

To automate your invoicing, implement an automated invoice processing system. This involves using software to capture, extract, and validate invoice data, integrate it into your accounting system, and set up automated approval workflows and payment schedules, reducing manual intervention and errors.

The automated invoice entry method uses software to capture invoice data, extract essential details through OCR data capture, and validate the information against predefined rules. This data is then automatically entered into your accounting or ERP system, streamlining the process and minimizing manual input errors.

AI invoice processing utilizes artificial intelligence to automate and enhance invoice management. This includes using machine learning and OCR technologies to capture, extract, and validate invoice data. AI algorithms improve accuracy, detect inconsistencies, and streamline workflows, making the entire process faster, more efficient, and error-free.

Yes, invoice processing can be automated using specialized software. This automation involves capturing invoice data, extracting essential details, validating the information, and integrating it into your accounting system. Automated workflows handle approvals and payments, significantly reducing manual intervention, improving accuracy, and enhancing efficiency.

To create an invoice processing system, start by selecting an automated invoice processing software. Set up the software to capture and scan invoices, extract essential data, and validate the information against predefined rules. Integrate the system with your accounting software, establish approval workflows, and automate payment schedules for streamlined operations.

Electronic invoice processing involves using digital tools to manage invoices. This process includes receiving invoices electronically, extracting and validating data with OCR and automated software, and integrating this information into your accounting system. It streamlines workflows, reduces manual tasks, and enhances accuracy and efficiency.